Exploring the Cutting Edge: Key Trends in the LLM and Generative AI Developer Community

The world of large language models (LLMs) and generative AI is evolving rapidly. As developers and innovators build new applications leveraging these powerful technologies, exciting trends are emerging that provide a glimpse into the future.

In reviewing recent project proposals from AI…

Architecture Maestro from Now On

Over the past couple of years, I’ve used GPT-3 almost every day to prototype, experiment, and to generally offload as much business and technical work as I can.

This past week I’ve been using GPT-4, and it’s a big leap over GPT-3.…

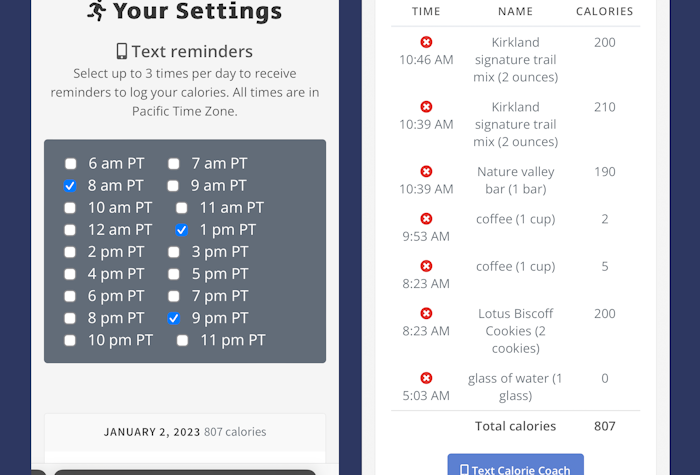

About Calorie Coach

Welcome

Calorie Coach is an AI-powered calorie tracking and fitness application available over SMS.

Anyone can use it simply texting 325-225-6743 (that’s 325-CALORIE) or by clicking the button on the website caloriecoach.ai.

Why track calories?

Losing weight isn’t rocket science. It’s about…

Launching DREAM.page

Today I launched DREAM.page, an AI-first personal publishing platform. This one was a joy to create, as it let me apply a lot of my LLM learnings in the context of a real app, and because making things is fun. See tweet…

AI assisted blog images

Read our latest blog post to find out more about Boris Johnson and the upcoming British leadership contest! With the race heating up, this is sure to be an interesting read. So check it out now and see what all the fuss…

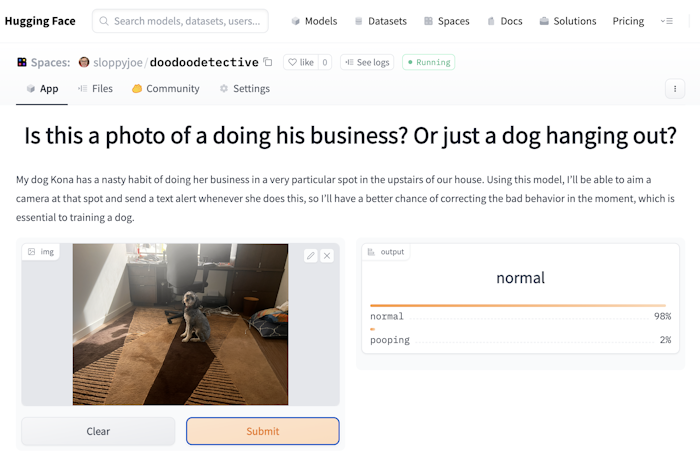

My first deep learning model: Doo Doo Detective

I’m taking Fast AI’s Practical Deep Learning for Coders class now and I’ve just created and deployed my very first end-to-end deep learning image recognition model. In Fast AI’s words, “using a model that’s so advanced it was considered at the cutting…

Developing a coding habit in a 12 year old

I sat with Aaron to do our first coding together in 6+ months and it was a total fail. He had forgotten even the most basic things.

Also, he reminded me that our approach last year wasn’t very fun for him. My…

Stable Diffusion Test

What if you wanted to add photos to a blog post? Well, if you’re using the blogging software I’ve always wanted, you just select the description and click “stable diffusion”, which adds a magic “stable-diffusion” tag and handles all the magic for…

Zoom meeting backgrounds (DALL·E 2)

Looking for a way to add a little bit of personality to your next Zoom meeting? Check out these DALL·E 2 AI-generated backgrounds! With a wide range of options to choose from, you're sure to find the perfect background to make your…

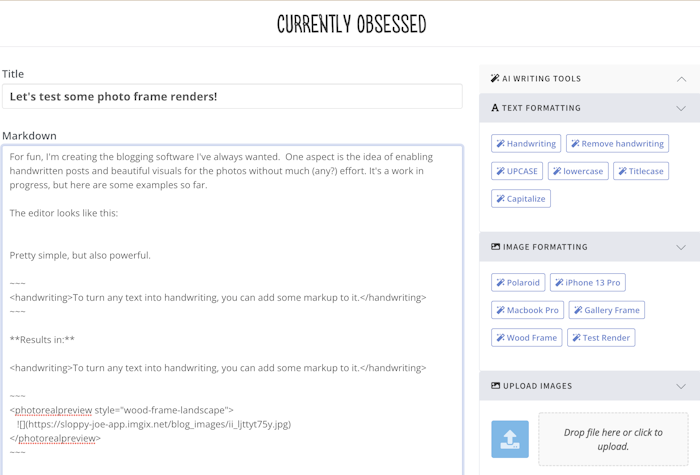

Let's test some photo frame renders!

I’m creating the blogging software I’ve always wanted. One aspect is the idea of enabling handwritten posts and beautiful visuals for the photos without much (any?) effort. It’s a work in progress, but here are some examples so far.

The editor, which…

More DALL·E 2 Generations

“Answer to the Ultimate Question of Life, the Universe, and Everything, Leica M11”

“Incredibly lifelike full-color illustration by John James Audubon, Bald Eagle with bell-bottoms and glitter jump suit at Disco Championships”

Next, I uploaded this picture of our dog and asked…

DALL·E 2 Generations in the style of Banksy

My friend Ed sent me some Banksy-oriented prompts to test out on DALL·E 2. He wrote,

I went to a Banksy exhibit last weekend and it was really amazing. Very clear style with powerful interesting messages. I wonder what DALL·E 2 could…

My first experiments with DALL·E

I just got access to DALL·E 2 and it's absolutely delightful. Here are my first few generations!

“Two Egyptian mummies enjoying espresso and some pizza somewhere in Italy (50mm lens high quality photo)”

Stable Diffusion:

“Lemon gelato that’s been shaped to look…

Open AI / GPT-3 Presentation

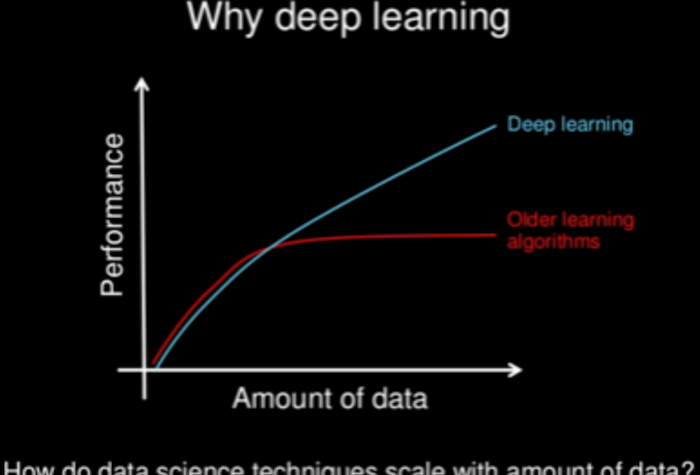

What is deep learning?

Deep learning is a subset of machine learning (ML), where artificial neural networks—algorithms modeled to work like the human brain—learn from large amounts of data.

Deep learning is a class of machine learning algorithms that uses multiple layers…

Projects

Welcome. This page describes some side projects and prototypes I’ve worked on recently.

Tinkering around with LLMs

AI Tinkerers - I started AI Tinkerers in Seattle, built the infrastructure that powers the website, and am working to expand the group to more…

“Please help me understand the value of working with a VC”

Someone recently asked me, “please help me understand the value of working with a VC.” Here’s an elaboration of what I responded:

* Some very large percent* of your company’s success will come from you and your team.

* The rest? Everyone…

What are you passionate about in a company?

Someone just asked me, “what are you passionate about in a company?”

Here’s my partial answer…

Be on a purposeful mission

I love “the hunt” involved in driving towards big goals. And while things like making money, shipping code, increasing some important…

Seattle Half Marathon Recap

Running through the downtown core in the fog, the streets filled with runners, felt like a zombie apocalypse...

Running in the cement confines of the I-90 tunnel was a kind of sensory deprivation. Felt like a giant treadmill. Guy with megaphone shouting…

How to Print Your Own Children’s Books (that won’t be eaten or torn apart)

We had a baby in August of 2010 and it’s been a whirlwind. Here’s a quick post having nothing to do with tech or startups, but if you have have infants or toddlers at home, you may be interested in this.

My…

How to Use Google Docs to Get Continuous User Feedback

This quick post shows you how to implement a continuous feedback system using Google Docs Forms and a simple script which I’ve included.

What’s Great About This

* Incredibly quick to set up (~5 minutes per survey)

* Realtime emails give you…